AGENDA

12:00pm ET - DISCUSSION

- Tax credits for clean energy production: how will make it be easier for CRE to source clean energy, comply with GHG reduction mandates, and otherwise tout their green credentials

- Tax credits for distributed clean energy: rooftop solar, heat pumps, small wind systems ; what are the incentives for homebuilders and developers

- Tax credits for energy efficiency in commercial buildings and the CRE implications

- EV tax credits may speed adoption of EVs by more consumers, leading to more demand for charging infrastructure in the CRE environment. But what exactly is the credit scheme?

- $27 billion to green bank and the implications for CRE

- Preservation of carried interest loophole

1:00pm - 1:30pm ET for “OVERTIME - LIVE QUESTIONS FROM THE AUDIENCE FOR THE PANEL!”

Speaker

David Amerikaner

Special Counsel

Duane Morris LLP

Read Profile

David Amerikaner is a member of Duane Morris’ Real Estate Practice Group and focuses his practice on land use, project development, environmental law, eminent domain, and sustainability.

Mr. Amerikaner advises developers, energy companies, and other large users of land through the process of obtaining permits and approvals to develop their land. This practice includes representation before local and state planning commissions, boards, councils, agencies, and other decisionmakers, as well as outreach to and negotiation with project opponents. Mr. Amerikaner’s experience spans several states and local jurisdictions, particularly the California Environmental Quality Act (CEQA) and other environmental and municipal regulations in California. He also handles litigation matters that arise from land development.

Mr. Amerikaner handles eminent domain matters for utilities seeking to condemn private properties for public use, and on behalf of private property owners whose properties have been condemned. He also represents private property owners in tax assessment appeals.

Mr. Amerikaner regularly counsels private equity firms, banks, sovereign wealth funds, and other entities on the environmental aspects of corporate transactions. He is experienced in performing due diligence, negotiating and drafting contractual provisions, and providing strategic advice in the context of mergers and acquisitions, divestitures, debt and equity financing, real estate transactions, and project finance.

Mr. Amerikaner has an active practice in the field of environmental commodities, including advising clients on the generation and trading of carbon credits and various types of mitigation credits. He also counsels clients on reducing their carbon footprints and complying with environmental mitigation requirements, on both voluntary and mandatory bases.

In addition, Mr. Amerikaner maintains a robust pro bono practice, including work on behalf of disadvantaged individuals related to land use, government approvals, real estate transactions, immigration, and Holocaust reparations.

Mr. Amerikaner is admitted to practice in Pennsylvania, New York and New Jersey. He is a former advisory board member of the Trust for Public Land New York State Chapter, and is active in fundraising and team building for the Juvenile Diabetes Research Foundation. Mr. Amerikaner is a graduate of the University of Pennsylvania Law School and Harvard University, and also received a master’s degree in Education Leadership from Teachers College at Columbia University.

Areas of Practice

-

Real Estate Law

-

Project Development

-

Land Use

Speaker

Tony Watson

Tax Consultant

Robert Hall & Associates

Read Profile

Tony Watson personally manages clients with over $350 Million dollars in real estate holdings. He has spoken for hundreds of trade organizations throughout the State of California. Holding a federal license as an Enrolled Agent tax practitioner, Tony can advise, represent, and prepare tax returns for individuals, partnerships, corporations, and any other entity with tax-reporting requirements.

Aside from his full-time position at Robert Hall & Associates, Tony is an active real estate investor, entrepreneur and enjoys short and long term trading. With over a decade and a half of experience, Tony, along his team at Robert Hall & Associates, actively look for the newest and most up-to-date strategies to implement on client tax filings. They all operate with the same goal in mind: to help taxpayers keep more of their wealth and not overspend with the federal and state revenue agencies.

Speaker

Alexander Heil, PhD

Senior Economist, The Conference Board

Former Chief Economist

The Port Authority of New York and New Jersey

Read Profile

Alex Heil, PhD, is a Senior Economist at The Conference Board. An applied economist, he has more than 20 years of experience in the energy, environment and infrastructure space. His work is centered on the energy transition, renewable energy resources, urban economics, and how infrastructure and transportation will affect development patterns and economic trends.

Before joining the Conference Board, Alex was VP for Research at the Citizens Budget Commission, a think tank focused on the finances and operations of New York City and State governments. Prior to CBC, Alex was the Chief Economist of the Port Authority of New York and New Jersey. In that role, he analyzed regional economic conditions, conducted regional cost benefit analysis, assessed the regional economic impacts of transportation investments, and undertook economic and financial project evaluations. He also worked as a consultant on energy and utility projects for private and public sector clients as an economist for CDM Smith, Inc.

Alex has been a frequent speaker and presenter at conferences and events for commercial real estate, transportation, and financial executives in the Greater New York metropolitan region and nationwide.

His background includes a strong focus on environmental economics and sustainability. He contributed to a Congressional Study on Investments in Transportation Resilience, and has been an adjunct faculty member in the Sustainability Management Program at Columbia University for nearly a decade.

Originally from Germany, he received his BSc from Hawai’i Pacific University in Honolulu, his MSc from Golden Gate University in San Francisco, and his PhD from the University of South Wales in the United Kingdom.

Speaker

David Blatt

CEO

CapStack Partners

Read Profile

David Blatt is the CEO of CapStack Partners, an asset manager specializing in real estate debt investments.

Prior to CapStack, Mr. Blatt was a founding Principal at DBP Capital in New York where he ran a special situations fund for over a decade that acquired and repositioned distressed real estate assets. Since 2001, Blatt has been involved in the negotiating and structuring of countless acquisitions and brings an expert level understanding to successfully capitalizing and closing a deal.

Mr. Blatt is a member of the Bloomberg Breakaway CEO network, an influential circle of international leaders, investors, technologists and policymakers, and has participated at the prestigious World Economic Forum in Davos, Switzerland. He is also a former NYU professor of Negotiation. He has hosted the real estate investment youtube and podcast, "Make the Deal: Real Estate Investing with David Blatt" and has been a regular contributor to New York’s top commercial real estate trade publication, Commercial Observer. He is a frequent public speaker on entrepreneurship, innovation and capital & investment trends in real estate. Mr. Blatt has been frequently sourced by national business and real estate trade outlets, including the Financial Times, LA Times, GlobeSt, Commercial Observer and The Real Deal for his expert opinions on how to make good investment decisions, how to effectively negotiate and structure deals and where to invest in the real estate industry.

Blatt earned a Bachelor’s of Science in Business Management from Yeshiva University, JD from Cardozo School of Law, Executive MBA from Baruch College, and Master's in Negotiation & Dispute Resolution from Pepperdine University School of Law. He is a Registered Investment Advisor, is admitted to practice law in New York, New Jersey and California., and is a real estate broker in New York and Florida.

Speaker

Nicholas F. Allen-Sandoz, PE, BEMP

Associate

JB&B Deep Carbon Reduction Group

Read Profile

Specialties: Standardization, Processes, Mentoring, Coaching, Understanding the specific audience and balancing high technical scrutiny with big-picture goals

Nicholas Allen-Sandoz, an Associate in the JB&B Deep Carbon Reduction Group, is a dedicated building science professional committed to the advancement of reliable building energy-efficiency practices throughout the industry. He has considerable experience with a diverse range of building types, including commercial, residential, academic, healthcare, life sciences, manufacturing, grocery stores, and sports complexes.

Mr. Allen-Sandoz has conducted advanced energy modeling analysis, ranging from 1 million+ square foot healthcare campus central plant upgrades to several LEED Platinum projects. He has performed extensive onsite field testing and analysis for energy audits and commissioning services, and has served as a technical consultant for several rating authorities having jurisdiction throughout the country, supporting the quality assurance of new construction and renovation energy modeling programs and enforcing program rule sets with program applicants. These combined skill sets give him an intimate understanding of the dynamic among day-to-day building failures, design intent, and actual realized performance.

A passionate educator and experienced orator and curriculum developer, he has conducted training sessions on building science and energy modeling for architects and engineers across the country, to groups as large as 100 people and as small as custom one-on-one online support.

Mr. Allen-Sandoz holds a Bachelor of Science degree in Mechanical Engineering and Mechanics from Drexel University. He is a licensed Professional Engineer in the State of New York, an ASHRAE Building Energy Modeling Professional (BEMP), and he also sits on the ASHRAE BEMP exam subcommittee to help develop new exam questions. He is a member of the Standing Standard Project Committee of ANSI/ASHRAE/IES Standard 90.1 Energy Standard for Building except Low-Rise Residential to help consult on new language and rulesets for future releases of the standard.

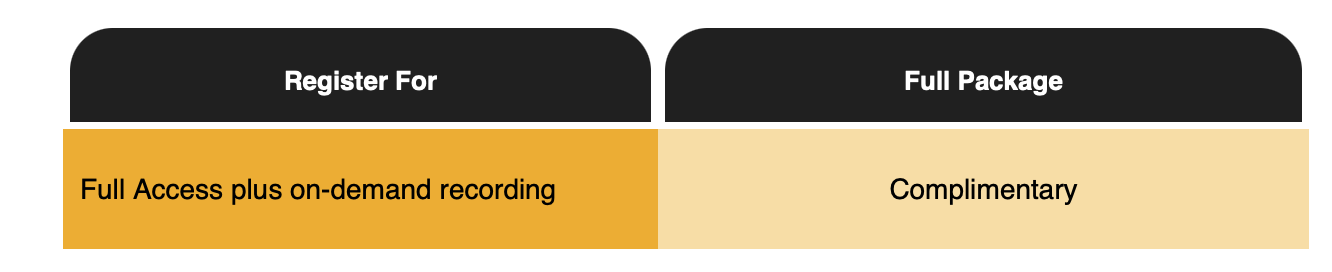

PRICING

Subscribe to our newsletter

Stay up to date on the latest events, news and conference announcements.