AGENDA

12:00pm ET - DISCUSSION

- Riverside's recommended approach to transitioning loans and hedges to SOFR

- The pros and cons of the four different SOFR indices in the market

- Nuances in your credit agreement and hedge requirements that may offer relief

1:00pm - 1:30pm ET for “OVERTIME - LIVE QUESTIONS FROM THE AUDIENCE FOR THE PANEL!”

Speaker

Joyce A. Frost

Partner

Riverside Risk Advisors LLC

Read Profile

Joyce Frost is co-founder of Riverside Risk Advisors and has over 25 years of experience in the interest rate, currency and credit derivatives markets. She is an industry leader in the LIBOR Transition and an active member of the ARRC’s Bilateral Business Loan Working Group, Accounting and Tax Working Group and Conforming Changes, Tax and Term SOFR sub-committees... ↓

Prior to founding Riverside, Joyce was a Senior Vice President of Cournot Capital Inc, a highly successful seller of credit protection sponsored by Morgan Stanley. In her capacity, Joyce assisted in ramping up a portfolio of over $25 billion in swap notional, securing triple AAA credit ratings from three agencies, issuing $250 million of Senior Debt, and facilitating the successful sale of Cournot to an affiliate of Magnetar Capital in 2008.

Prior to Morgan Stanley and before a six year retirement, Joyce was Head of Marketing for Chase's newly-formed Credit Derivatives Group. Between 1995 and 2001, Joyce contributed to the development and execution of the bank's first credit derivatives transactions, including total return swaps, credit default swaps, off balance sheet financing vehicles and the market's first synthetic CLO. Her clients ranged from banks, insurance companies, hedge funds and corporations. During her tenure, Chase's Credit Derivatives group was rated "Best in Credit Derivatives" by Global Finance Magazine and "Best in Credit Derivatives" by Derivatives Strategies Magazine, in addition to other premier industry recognitions.

Between 1985 and 1995, Joyce was responsible for marketing fixed income derivatives to corporate, project finance, real estate and other end users. Joyce successfully concluded hundreds of transactions ranging from plain vanilla swaps to the most complex cross-border project finance transactions in Latin America. She started her fixed income career at The Northern Trust Company, continued at Chase and spent five years at Sumitomo Bank Capital Markets.

Joyce is Co-Editor of the Handbook of Credit Derivatives (McGraw Hill, 1999) and author of many articles published on the use of derivatives by corporations and other end-users. She has spoken at dozens of industry conferences throughout North and South America and Europe.

Joyce earned a B.S. in Finance from Indiana University’s Kelley School of Business, an MBA in Finance from the University of Chicago’s Booth School of Business and completed MIT Sloan School of Management's Executive Program: Artificial Intelligence: Implications for Business Strategy.

Joyce was honored to receive the Legacy Award for the 2019 Market Choice Award: Women in Finance in New York City.

She currently is Board Chair of Excellence Community Schools, a network of charter schools in New York City and Stamford CT, Founding Chair and current VP, Board of Trustees of the Bronx Charter School for Excellence, one of the top rated charter schools in New York State, and a thirty-year member of the Board of Directors of New York Cares, New York City’s premier volunteer organization.

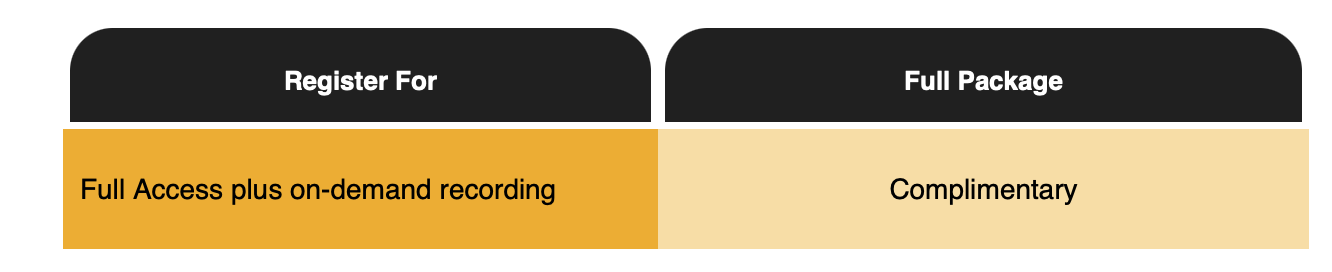

PRICING

Subscribe to our newsletter

Stay up to date on the latest events, news and conference announcements.